Property taxes are an essential source of revenue for local governments. They are used for funding public infrastructure and services such as schools, hospitals, and emergency response. Property taxes are assessed on real estate properties based on their market value. The amount owed is often calculated based on the property’s assessed value.

There are several documents that are associated with property taxes, including property assessments, tax notices, and tax certificates. While all three of these documents are related to property taxes, they serve different purposes and are used at different stages of the property tax collection process.

Property Assessment

Property assessment is a process of evaluating a property’s value to determine the amount of taxes that will be levied. Assessments are based on a variety of factors such as location, size, and condition of the property. This evaluation is usually conducted on a periodic basis. The assessed value may change from one assessment cycle to the next, depending on market fluctuations and changes to the property.

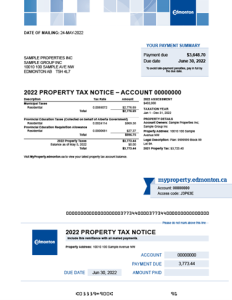

Property Tax Notice

Most municipalities distribute property tax notices in late May every year. Property owners are expected to pay their taxes in full by the due date of June 30. The notice will contain the assessed value of the property, the tax rate, and any applicable deductions. Property owners are usually required to pay their taxes in installments, and the tax bill will indicate the due dates for each payment to avoid late-payment penalties. A property tax notice is required for refinance and switch mortgage transactions to confirm the property tax amount and that they are not in arrears.

Property Tax Certificate

A property tax certificate is a document certifying that all taxes due on a property have been paid up to a certain date. The tax certificate is issued by the municipality and serves as proof that the property owner is up to date with their tax payments. Tax certificates are often required for real estate transactions, such as when a property is sold, refinanced, or transferred, to ensure that all taxes have been paid. A tax certificate provides the roll number, legal description, property address, levy, current balance, arrears, utility account balance, and Monthly Tax Payment Plan amount. You can order a property tax certificate here>>

The difference between a property assessment and a tax notice is that the assessment is the process of evaluating a property’s value to determine the amount of taxes, while the tax notice outlines the amount of taxes owed by a property owner for a specific period. The tax certificate is a document certifying that all taxes due on a property have been paid up to a certain date.