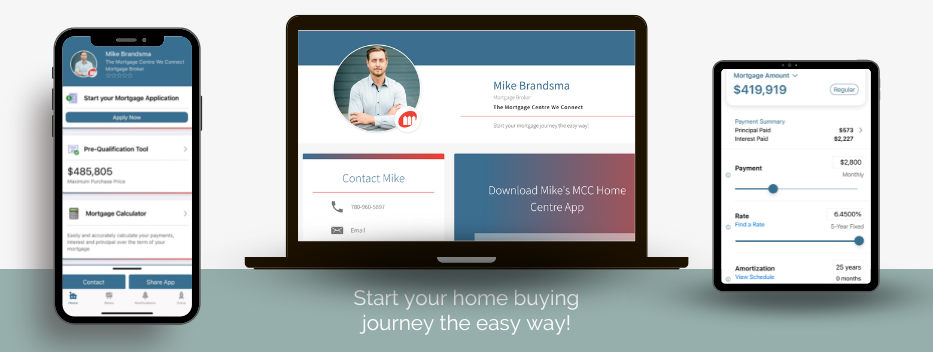

Spruce Grove Mortgage Calculator for Renewal & Buying a Home

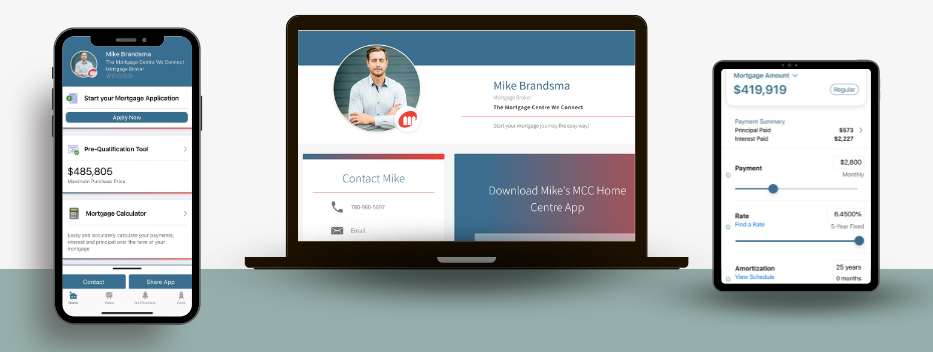

Spruce Grove Mortgage Renewal Made Simple with Our Calculator Wondering what your monthly mortgage payments might look like? Our Canadian Mortgage Calculator is designed to give […]

Read more